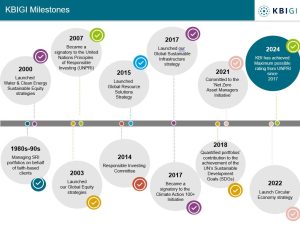

KBIGI Milestones

One of our principal goals as an investment firm is to help clients exceed their long-term objectives through offering value-adding, differentiated products. We believe investment strategies should enable investors to generate consistent alpha with less risk. KBI GIobal Investors has AUM of over €10.5bn as at 31st March 2025. This is the combined AUM of KBI Global Investors Ltd and KBI Global Investors (North America) Ltd.

Our strategies are designed to capture long-term investment trends that we believe are relevant for the foreseeable future: In terms of our Global Equity strategies, these are designed to capture long term trends in demographics (larger population living longer), a lower return environment and the requirement for more income. In terms of the Natural Resource strategies, these are all designed to seek out and find the companies that will be the solutions providers to the problems created by significant increase in demand for water, food and energy over the next number of decades. This demand is driven by population growth and compounded by urbanisation, industrialisation, increased affluence and increased regulations.

KBI Global Investors has a strong commitment to Responsible Investing (RI) issues, and has managed Responsible Investment strategies for more than three decades.

Responsible Investing at this firm began in part because of our original Irish client base, which required a faith-based approach to investing. As such, we implemented negative screens into our process as far back as the early 1980s, in order to incorporate various ‘ethical’ criteria such as humanitarian and animal welfare issues for our clients. Today, our investment process has evolved from the simple negative screens utilised for our original faith-based clients to a fully integrated, decisive commitment to Responsible Investing, serving endowments, foundations, and institutional investors across the globe.

At KBI Global Investors, we have designed the business around specialist investment teams. This focus on specialisation is extremely important in allowing us to generate excess return for our clients. Each team is exclusively focused on understanding the nuances of markets, themes, sectors and companies specific to their strategy enabling them to consistently gain insights that investors with a broader focus may miss. We believe this approach has been, and will continue to be, an integral element of the overall value-add for our clients.

KBIGI will continue to grow its client base and reinforce its position as a leading specialist equity manager by consistently demonstrating the capability to add value for clients and exceed their expectations based on four core pillars: