What is “Impact” and why is it important to measure it?

Impact is the measurable, beneficial social or environmental effect an investment generates alongside its financial return. However, one issue with beneficial impacts is that they are often hard to measure.

For example, investing in food safety has a clear beneficial impact (preventing illness), but how material is the impact relative to the size of the investment, and/or to the size of the investment portfolio?

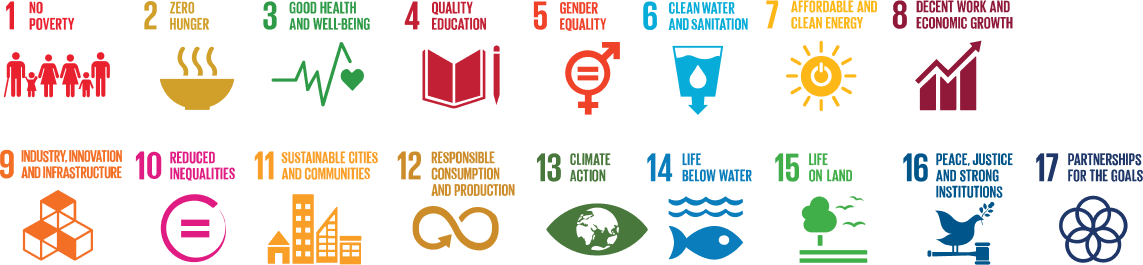

What are the SDGs

In 2015, the UN adopted 17 Sustainable Development Goals (SDGs), a measurable set of social and economic targets to be achieved by 2030. They cover a range of issues like poverty, hunger, health, education, climate change, gender equality, water energy, sanitation, environment and social justice.

How We Measure Impact

Our Natural Resources Strategies invest in companies addressing global shortages in clean and safe food, water and energy. So, it’s clear these strategies have social and environmental benefits, it is obviously “Impact” investing.

Challenges

However, for investors ‘impact’ can be difficult to quantify. We simply can’t add the benefits of clean water to reduced carbon emissions or add safer food to increase food production.

Customised Methodology*

Instead, we look at the total revenue of companies in our portfolios and allocate it to various business activities. We then calculate whether each activity makes a positive, neutral or negative contribution to achieving the UN SDGs.

Results

Through weighting, we can then calculate what percentage of a portfolio’s revenue is positively or negatively contributing to achieving those goals.

*Calculations are based on KBIGI’s own methodology and are not independently verified . Where revenue figures are unavailable, or are misleading due to the nature of the company, alternative metrics may be used